How will you pay for your dream home? Construction financing can be complex as it needs to be structured in accordance with your project schedule and construction timeline. It’s a challenge to get your banker, builder, lawyer, and mortgage broker on the same page – but it’s possible when you have an experienced team to guide you. Here are a few points to consider:

Construction financing: Banks vs. Private lenders

Banks

Banks are your safe bet. The majority of clients that want to build custom homes or construct investment properties already have a long-term relationship with a banking institution. You may have a trusted professional at the bank that you’ve dealt with for previous mortgages or other financial transactions. This helps when trying to secure financing for your project.

What’s more, a bank will give you the best loan for your construction mortgage. They provide the lowest rate due to their size and their tendency to only accept low-risk clients. This is good news if you’re categorized as low-risk. To be considered for a bank loan, you may be required to have a consistent income, put at least 20% of the total cost as a down payment, be the full owner of the land you wish to build on, and be debt-free. If this sounds like you, your best bet is to go to a bank to get financing for your custom home or multi-unit/investment property.

Private Lenders

If you don’t fit the bank’s lending criteria, you may go with a private lender. These often lend to higher risk clients or assist in structuring unique financing requirements that commercial institutions find too high risk.

Private lenders carry a multitude capacities and abilities in lending. To keep things concise, private lenders often lend to higher risk clients or assist in structuring unique financing requirements that many commercial institutions find too high risk. For example, if you have a consistent income, have 20% down minimum on your project but have an outstanding debt, private lenders may be able to work out terms for you to qualify for a loan. Similarly, if you are a sole proprietor and do not have two years of business history, this may be accepted circumstantially. The counter to the flexibility in loaning is higher interest rates on your construction loan for your custom home or multi-unit renovation project. Again, this option has a higher cost for the money you are loaning, but sometimes is the only option.

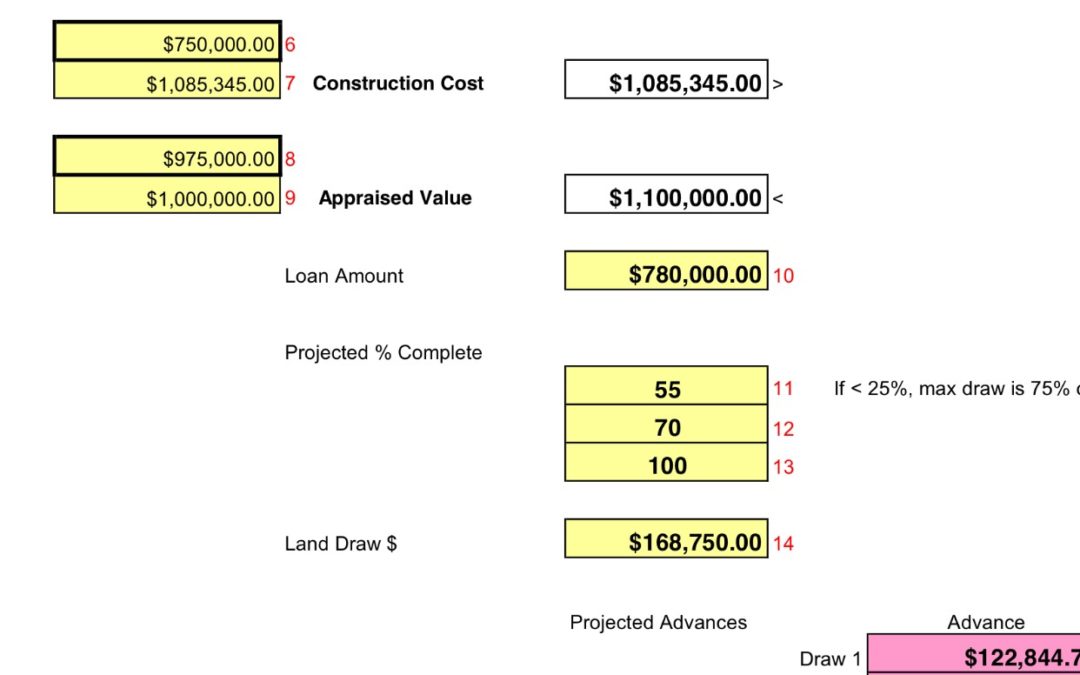

Timing your Construction Draws

Each lender will have a standard system that they abide by for providing you with a construction loan for your custom home in Ottawa. As standard, they will set out checkpoints in the construction process to issue portions of your total loan based on the total production of the project. As these deadlines can be the difference between finishing aspects of your project or incurring major setbacks, it is very important to have an experienced construction professional time your finance draws in accordance with the construction process. If your financing and your construction timeline are out of sync, you may run into unexpected increased costs on both the construction and financing aspects. To avoid this, choose a qualified project manager or custom home builder to time your construction finance draws when building in Ottawa.

Keeping a contingency

Contingency for projects varies based on the scope and detail of the construction project. A rule of thumb is to keep 10–15% contingency for investment properties. This may not apply to custom homes as they can vary considerably. Although you can complete a custom home with a 10–15% contingency, often many changes occur and high-end details are built within the home. Due to this, it is always smart to carry a 20–25% contingency for custom homes. If you end up not using the full contingency – that’s great! It’s always better to be safe than sorry when building your project. Ultimately, a good construction project manager will have a background in estimating and be able to give you an accurate budget. Your estimate is your blueprint for your valuation – so it is critical that it is accurate and properly calculated from historical data. At Orange Design and Build, we provide a comprehensive financial projection and construction budget with each project we undertake in Ottawa.